Wānaka median house price slides

Tony O'Regan

27 February 2023, 4:04 PM

Wānaka’s median house price is 50 percent higher than it was in 2021. PHOTO: Wānaka App

Wānaka’s median house price is 50 percent higher than it was in 2021. PHOTO: Wānaka AppWānaka house prices recorded a year on year decline of 9.4 percent in January according to the latest data from the Real Estate Institute of New Zealand (REINZ).

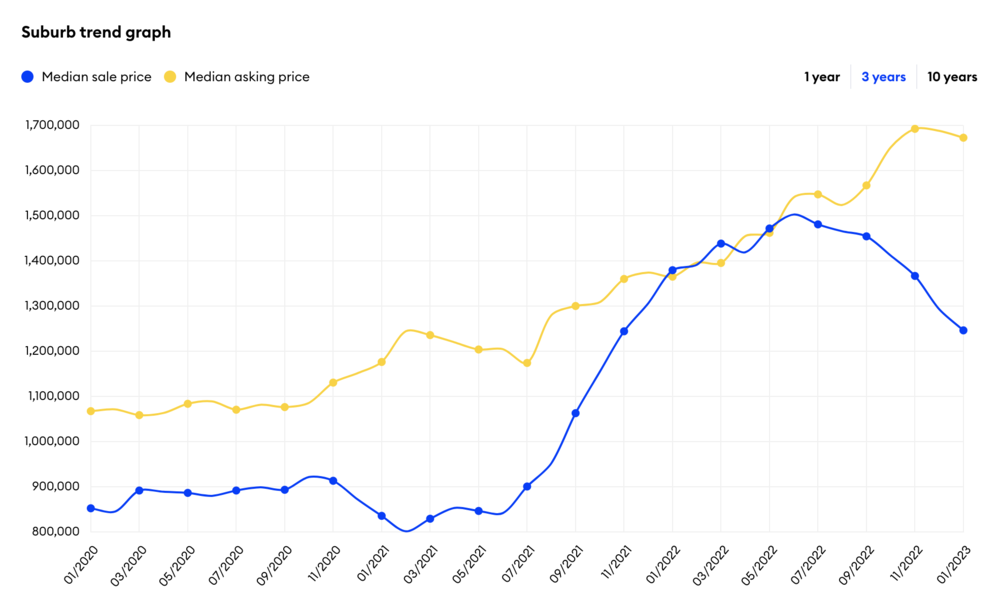

The median house price was $1.25M in January 2023 compared to $1.38M in January 2022, and is down 16.7 percent from June 2022 when the market reached its peak recording a median house price of $1.5M.

Harcourts Wānaka general manager Grant Parker said care needs to be taken when commenting on each month as towns with lower volumes compared to cities can produce volatile statistics.

“The general nature of the national economy, along with interest rises towards the second half of 2022 may be contributors to the decline of the median house price,” he said.

“In saying that we are currently experiencing a lift in enquiry and our most recent auctions last week saw four from six… properties sell under the hammer with another property having activity soon after.”

The blue line shows Wānaka’s median house price trend. IMAGE: Realestate.co.nz

REINZ CEO Jen Baird said nationally properties are spending longer on the market with 53 being the median number of days to sell across the country for January 2023.

“High interest rates, the ability to secure finance, commentary around a looming recession and this being election year can be added to factors for slow decision making from buyers,” she said.

Ray White Wānaka director Duncan Good said the number of days to sell a home in Wānaka has risen above 50 from a long term average of 43 days.

“This is typically seen when we see stock levels in the region rise as there's more options out there for buyers to consider,” he said.

Despite the recent drop in Wānaka’s median house price, current prices are 50 percent higher than 2021 when the median price was $0.83M.

According to the latest CoreLogic Housing Affordability Report, interest rate hikes are wiping out housing affordability gains with mortgage repayments eating up a big chunk of people’s income.

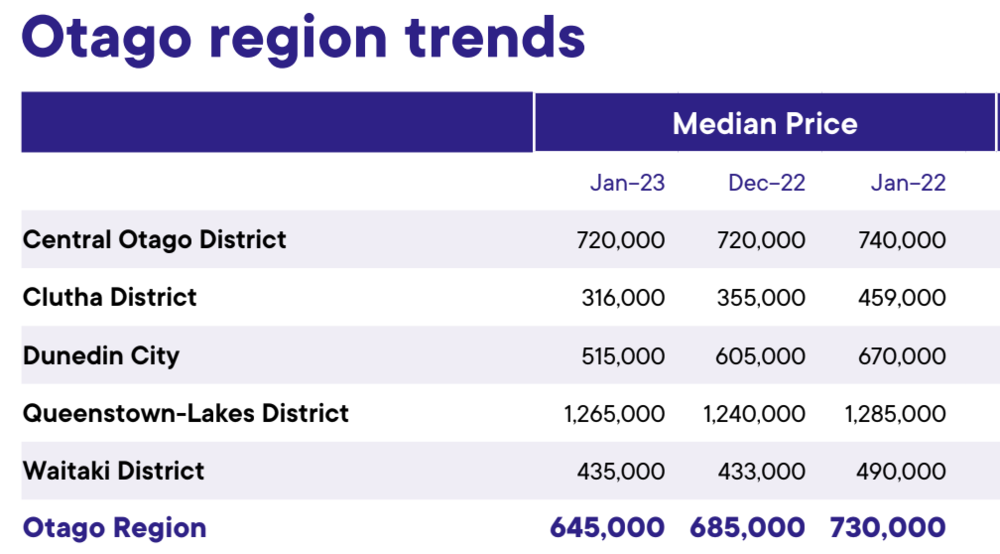

Source: REINZ Monthly Property Report

Kiwis are spending more than half their income (53 percent) on mortgage repayments to service an 80 percent LVR mortgage, the report stated.

A flattening of mortgage rates, coupled with further house price falls and continued income growth could offer some respite for borrowers in the future.